CapitaLand Ascendas REIT - She will need ti clear 2.69/2.70 smoothly in order to rise up further towards 2.83!

Yield is about 5.6 percent at 2.65 seem quite good!

Pls dyodd.

CapitaLand Ascendas REIT - Nibbled a bit at 2.58 i think the price is rather undervalued! Yield is about 5.8 percent, gearing is healthy below 40 percent, occupancy rate is above 94 percent! Pls dyodd.

CapitaLand Ascendas REIT - 1st quarter results update is out! Occupancy rate 93.3 percent, Divestment of properties at 64.2m, Gearing is healthy at 38.3 percent and positive rental reversion of 16.9 percent.

75 percent fixed loan rate. Nothing mentioned about Gross Revenue and NPI. The numbers seem not bad!

Chart wise, 2.47 looks like a great pivot support point!

Golden opportunity is back!

Pls dyodd.

CapitaLand Integrated comm Tr - She has broken down 1.89 likely to go down to revisit 1.81 than 1.79.

At 1.85, yield is about 5.8 percent which is quite a good yield level!Pls dyodd.

CapLand IntCom Tr (C38U.SI) - I think Great sales is back! Treading at 1.92, yield is about 5.6 percent for this Class A Office cum Shopping Mall reit is worthy to take a closer look! Do take note!

NAV 2.11.

I think she may go down to revisit 1.89 which might be a great pivot point to consider!

Pls dyodd.

Meeting Date29 April 2024

2.30 P.M. AT THE STAR GALLERY LEVEL 3, THE STAR PERFORMING ARTS CENTRE 1 VISTA EXCHANGE GREEN SINGAPORE 138617 OR BY ELECTRONIC MEANS.

CapLand IntCom Tr - She is gaining strength and may likely rise up to reclaim 2.00 again! A nice breakout smoothly plus good volume we may see her rising up towards 2.03 than 2.07.

Yield is about 5.43 percent at 1.97. I think seem quite a nice Yield! Pls dyodd.

31st January 2024:

CapLand IntCom Tr - She is slowly climbing up again and managed to touch 2.02, looks rather positive! A nice breakout of 2.02 smoothly we may see her revisiting 2.08 again!

Quote:

Temasek's Fullerton acquires 795,700 units in CICT at $1.9019 each.

Looks like they are seeing price trading at an attractive price level.

Likely to rise up to test 2.09 than 2.16.

Pls dyodd.

CapLand IntCom Tr - Fantastic! She has managed to cross over 1.91 smoothly and closed well at 2.01, this bullish momentum may likely continue to rise higher towards 2.09-2.10.

Huat ah!

Pls dyodd.

Hosey! She is going to Gap up and run away!

Likely to cross over 1.91 smoothly and rises up towards 2.00 than 2.07.

Pls dyodd.

Fed Holds Rates Steady, Indicates Three Cuts Coming in 2024

The Federal Reserve on Wednesday held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond.

The Dow Jones industrial average hit its first record closing high since January 2022 and the S&P 500 and Nasdaq rallied more than 1% each on Wednesday after the Federal Reserve signaled that its interest rate-hiking policy is at an end and that it sees lower borrowing costs in 2024.

When will she be able to overcome the resistance at 1.90! A nice breakout smoothly plus high volume would likely see her rising up to 1.95-1.97 than 2.07.

Pls dyodd.

Looks like she may cross over the resistance at 1.90 any moment!

Pathing way foe 1.95 than 2.00 with extension to 2.09.

Pls dyodd.

Chart wise, bullish mode!

Short term wise, she may likely rise up to test 1.90 Tyan 1.95 with extension to 2.07-2.09.

Not a call to buy or sell!

Please dyodd.

It seems like it is having a temporary rebound as the volume is still low not so convincing!

Pls dyodd.

At 1.69, yield is about 6.27% of which I think is quite a gd yield for this giant retail cum grade A office reit.

NAV 2.12.

3rd quarter Results update will be out on 26th October.

Not a call to buy or sell!

Pls dyodd.

CapitaLand Integrated Commercial Trust (CICT or the Trust) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) with a market capitalisation of S$13.5 billion as at 31 December 2022. It debuted on SGX-ST as CapitaLand Mall Trust in July 2002 and was renamed CICT in November 2020 following the merger with CapitaLand Commercial Trust (CCT).

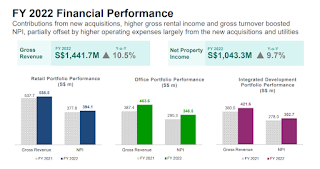

Looking at the FY 2022 results the NPI is up 9.7% and achieved an increased of DPU from 10.40 to 10.58 cents. It looks like the rental income is improving!

The First Quarter 2023 update is as follow:The NPI is up 11.3% to 276.3m and occupancy rate % has improved from 95.8 to 96.2.

The gearing is slightly from 40.90 to 40.40%.

The Average WALE is 3.7 years.

The Top 10 tenants are RC Hotels (Pte) Ltd, WeWork Singapore, GIC Private Limited, NTUC Enterprise Co-Operative Ltd & Temasek Holdings etc.

Total Property value is about 24.2 billion of which is the Biggest reit counter listed on the Local Singapore Exchange.

NAV is about 2.116.

Yearly dividend of about 10.58, Yield is about 5.6%(based on current price of 1.89).

I think gd pivot entry point is back!

Please dyodd.