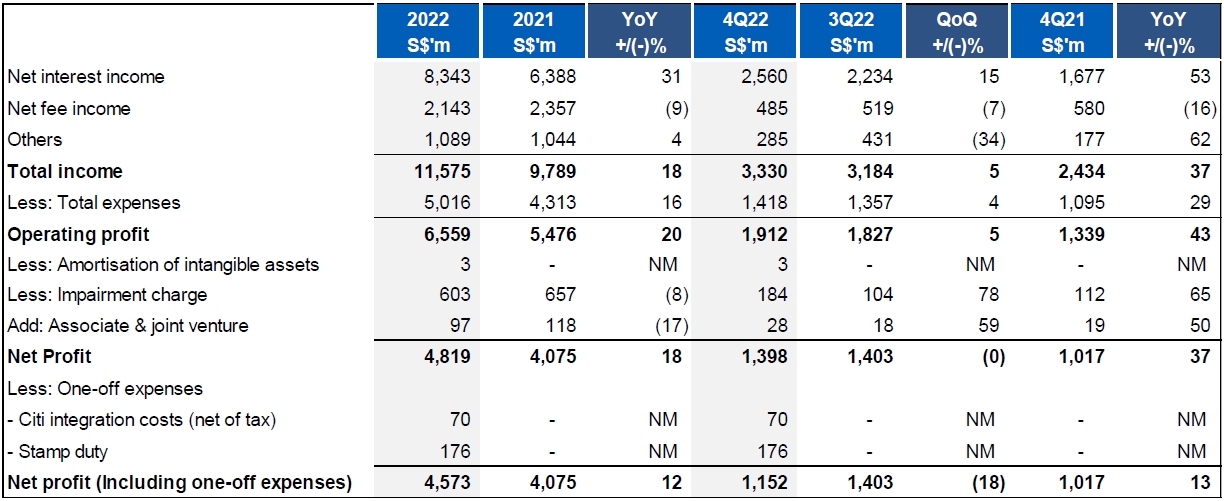

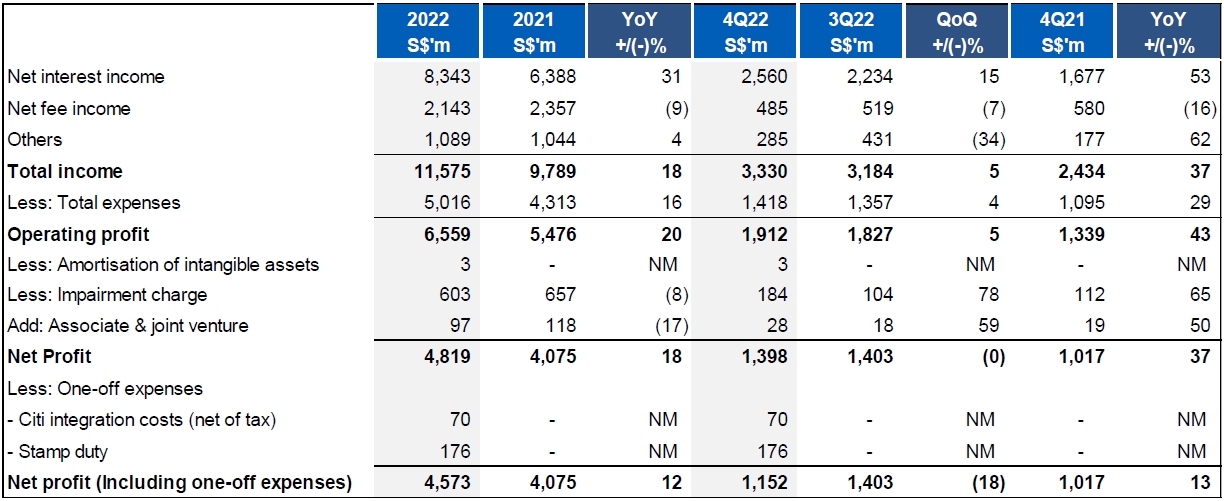

UOB Group reported a record high core net profit of S$4.8 billion, up 18%, for the financial year ended 31 December 2022 (FY22). Including one-off expenses relating to the acquisition of Citigroup’s Malaysia and Thailand consumer businesses, net profit was also a record high at S$4.6 billion.

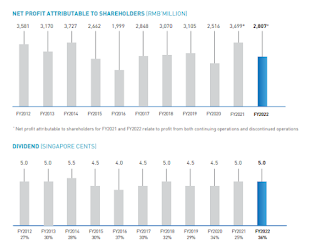

With strong earnings and capital position, the Board recommends the payment of a final dividend of 75 cents per ordinary share. Together with the interim dividend of 60 cents per ordinary share, the total dividend for FY22 will be S$1.35 per ordinary share, representing a payout ratio of approximately 49%.

The acquisition of Citigroup’s consumer businesses in Malaysia and Thailand was completed in November 2022 and completion for Indonesia and Vietnam is planned for 2023. The strategic acquisition has fortified the Group’s ASEAN strategy and significantly scaled up the retail franchise with increased product offerings and cross-sell opportunities. The Group’s retail customer base has expanded to nearly 7 million in the region while the expected incremental revenue lift from the acquisition is gaining good traction.

In FY22, the Group’s core operating profit rose 20% to S$6.6 billion, mainly driven by robust margin expansion across customer segments and geographies amid rising interest rates. Net interest income jumped 31% to S$8.3 billion on the back of 3% loan growth and a 30 basis point net interest margin improvement. Net fee income remained soft as weak market sentiment weighed on wealth management and loan-related activities. However, a strong double-digit growth in credit card fees partially offset the decline. Asset quality remained benign with non-performing loan (NPL) ratio at 1.6%.

Group Wholesale Banking income rose 23% to S$6.2 billion, with cross-border income up 12%. Transaction banking business expanded, accounting for 35% of the Group’s Wholesale Banking income. Improvement in deposit funding, coupled with rising interest rates fuelled margin growth, which more than compensated for the softer loans growth.

Group Retail income increased 16% to S$4.1 billion. Net interest income was boosted by rising interest rates and the Group’s active balance sheet management to optimise funding cost. Credit card fees surged as consumer spending and regional travel rebounded, boosted by the addition of Citigroup’s consumer businesses in Malaysia and Thailand. Despite market volatility, net new money inflows grew assets under management from affluent customers to S$154 billion. Organically, the Group also added over 800,000 new-to-bank customers, of which more than half were digitally acquired.

The Group continued to make headway on its sustainability strategy in 2022. In November, it announced its net zero commitments by 2050. The Group is working closely with its customers to support them in their transition in an orderly and just manner, focusing on balancing growth with responsibility. The Group’s sustainable financing portfolio reached S$25 billion in FY22, well on track to achieve its target of S$30 billion by 2025. The Group’s total assets under management in environmental, social and governance-focused investments also grew to S$10 billion during the year.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “The Group delivered a record net profit for the year, on higher margins driven by our robust core businesses, strong balance sheet and resilient asset quality.

“Importantly, 2022 was a milestone year for UOB with our acquisition of Citigroup’s consumer banking businesses in four markets. Last November, we completed the acquisition in Malaysia and Thailand and we aim to close in Indonesia and Vietnam this year. This transformational deal, sealed in the midst of the pandemic, positions us well in our strategic ambitions in the regional consumer banking space. We are excited to serve our enlarged customer base of 7 million with our expanded network and strengthened capabilities.

“The ASEAN region is vibrant with immense long-term potential. We remain positive on the region despite the global economic gloom in the near term. Looking ahead, we are confident that our strategy of seeking growth while ensuring stability will continue to create value for our customers and other stakeholders.”

Financial Performance

FY22 versus FY21

Core net profit for FY22 grew 18% to a new high of S$4.8 billion from a year ago, boosted by strong net interest income and stable asset quality. Including the one-off expenses, net profit was at S$4.6 billion.

Net interest income increased 31% to S$8.3 billion, led by robust net interest margin expansion of 30 basis points to 1.86% on rising interest rates and loan growth of 3%.

Despite credit card fees registering a double-digit growth from higher customer spending and the consolidation of Citigroup’s credit card business, net fee income declined 9% to S$2.1 billion as muted investor sentiments weighed on wealth and fund management fees.

Customer-related treasury income grew 20%, driven by hedging demands amid market volatility. This was partly offset by impact on hedges and lower valuation on investments. As such, other non-interest income increased 4% to S$1.1 billion.

With income growth outpacing rise in total core operating expenses of 16% to S$5.0 billion, cost-to-income ratio improved by 0.8% points to 43.3%.

Asset quality remained stable. Total allowance declined 8% to S$603 million with the release of pre-emptive general allowance that offset the higher specific allowance. Total credit costs on loans were maintained at 20 basis points.

4Q22 versus 3Q22

Core net profit for the fourth quarter was stable at S$1.4 billion. Including the one-off integration expenses, net profit stood at $1.2 billion.

Net interest income rose 15% to a new record of S$2.6 billion, driven by a 27 basis points uplift in net interest margin to 2.22%. Net fee income was down 7% to S$485 million, due to seasonal slowdown in wealth management and loan-related activities, although credit card fees was at new high from higher customer spends, further boosted by consolidation of Citigroup’s consumer business. Other non-interest income normalised to S$285 million, after an exceptional 3Q22 that benefitted from market volatilities.

Total core operating expenses increased 4% to S$1.4 billion while the cost-to-income ratio was unchanged at 42.6%. Total allowance increased to S$184 million, mainly due to higher specific allowance on a few non-systemic accounts, cushioned by the write-back of general allowance.

4Q22 versus 4Q21

Net interest income increased 53%, led by a 66 basis point expansion in net interest margin and loan growth of 3%. Net fee income was 16% lower as robust credit card fees were more than offset by softer wealth management and loan-related fees. Other non-interest income rose 62% to S$285 million on higher customer-related treasury income.

With strong income growth and disciplined cost management, cost-to-income ratio improved from 45.0% to 42.6%, excluding one-off expenses. Total allowance was S$184 million from higher specific allowance.