Riverstone Resources is established in year 1989, and still growing in our industry. With a history spanning close to 30 years, Riverstone has accumulated a huge network of stakeholders and expertise in our making. Being one of the leading manufacturers of cleanroom and medical industry, we manufacture top of the line healthcare gloves, nitrile gloves, finger cots, face masks, packaging bags etc. We are where we are today for the full supports from most valued customers and dedications from our staffs. Riverstone today is synonymous with premium quality and protection.

We are driven by innovation. Our passion to deliver premium quality healthcare solutions is recognized by many companies. Our products are widely qualified, and used in the Hard Disk Drive (HDD), semiconductor and healthcare industries in Malaysia. On top of the achievements, Riverstone exports more than 85% of our products to key high technology countries around Asia, Europe and the American region.

Riverstone has been growing extensively, for the amazing recognition for our products around the world. To cope with growing demands, we have increased our capacity by setting up a new manufacturing plant in Thailand in year 2001, and another one in Wu Xi China in year 2004. Later in year 2010, we built a new plant in Taiping, equipped with only state of the art manufacturing facility to keep our promises for premium quality.

The Riverstone website comprehensively provides up to date information, and our products. Browse through our website to better understand us, as we hope to bring only the best for all healthcare professionals.

Gloves and Cleanroom Products Manufacturer in Malaysia

Riverstone manufactures premium quality healthcare gloves & cleanroom products, for safety and hygiene purposes. Our products are widely used in industries like healthcare, semi conductors, manufacturing, bio tech, laboratory, pharmaceutical etc. Among the products we offer, it covers nitrile gloves,, medical examination gloves, finger cots, cleanroom gloves, cleanroom bags, packaging bags, face masks and growing. Each product goes through stringent test, to meet the highest industrial standards. These products are well recognized by local companies, as well as key countries around the globe. We export 85% of our products to America and countries from Europe and Asia region. Browse through our product gallery to better understand Riverstone.

Production in the cleanroom and the use of cleanroom technology are increasingly important. Cleanrooms can be found in industry involved in manufacturing process, such as semiconductor manufacturing, pharmaceuticals, biotech, medical device and life sciences, aerospace, optics, military and Department of Energy. The purpose of cleanroom is to reduce the contamination and control environmental parameters such as temperature, humidity and pressure. The more sensitive is the product, the stricter on the requirements for production conditions to make sure all the item is under control.

Before entering or exiting the cleanroom, individual need to go through airlocks, air showers and / or gowning room at the entrance and exit. Special clothing for cleanroom is designed to trap contaminants from skin and the body. There are several cleanroom garments which include boots, shoes, aprons, beard covers, bouffant caps, coveralls, face masks, frocks/lab coats, gowns, glove and finger cots, hairnets, hoods, sleeves and shoe covers.

As a global supplier for cleanroom products, we had categorized accordingly include cleanroom gloves, cleanroom finger cots, cleanroom packaging bags, cleanroom face masks, cleanroom wipers, and other consumables products. All the products are certified and suitable for use in class 10 and Class 100 cleanroom environment. Riverstone is practicing in-house special formulation in the manufacturing process. All the products are made of 100% virgin materials to make sure the quality of items are safe to use and meet the criteria. Each items produced undergo test such as APC, IC, FTIR, and NVR before shipment. The prices are different according to the performance, and

functionality to meet every client’s needs and requirements.

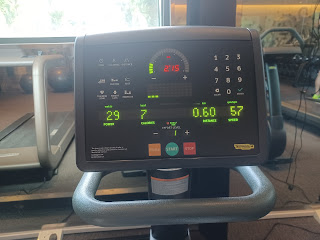

Chart wise, she is still stuck in a consolidation mode price patterns!

A nice crossing over of 0.625 smoothly plus good volume that may likely drive the price higher!

Yearly dividend of about 6 cents.

Yield is about 9%+.

Not a call to buy or sell!

Please dyodd.