Chart wise, bullish mode!

She has managed to cross over the recent high of 87 cents and closed well at 87.5 looks like this bullish momentum will continue and push the price higher towards 90 than 93 cents!

They own 2 of the local famous Shopping mall like Paragon and Clementi Mall.

Yield is about 5.5% at 87m5 cents, I think is quite a decent yield level!

Pls dyodd.

Wow! Nice uptrend mode!

She is rising up to test 90 cents than 93 cents with extension to 1.00.

Pls dyodd.

Yesterday, closed slightly higher at 82.5 cents I think good progress and we may see further buying activities!

Paragon REIT - I think reit are slowly gaining strength and likely to continue to trend higher due to interest rate has peaked and paused! Looking at the chart she is trading near the historical low and might be presenting a golden opportunity at the current price level and slowly moving back to 1.00 target price!

Pls dyodd.

Chart wise, she has managed to bounce-off from 79 cents and touched the high of 85.5 cents and retracing down at 81.5-82 cents looks like a gd pivot point!

Yield is about 5.91% ay 81.5 cents.

NAV 90 cents. Gearing 30.1%. Pls dyodd.

3rd quarter results is out! I think results is not bad! Gross Revenue is up 1.2% to 215.6m. Gearing is 30.1% and Occupancy rate is 98.1%.

No refinancing in 2.4 years time.

Not a call to buy or sell!

Pls dyodd.

She is due to report her 3rd quarter results on 31st October!

Yield is about 6.05% , buay pai!

Pls dyodd.

Chart wise, bearish mode!

I think she may go down to test 0.80.

Next support is at 0.79 and 0.725.

Pls dyodd.

Wah, it has broken down 88 cents and closed lower at 83.5 cents, looks rather negative and may continue to trend lower!

Today closing 1 big transactions sold down at 83.5 cents.

I think likely to test 83 cents.

Next, 79- 80 cents is possible!

Pls dyodd.

Chart wise, bearish mode!

Today spotted big quantities selling own at 0.89 cents. Now trading at 0.885.

If 0.88 cannot hold, then we may see her going down to test 0.83 than 0.79.

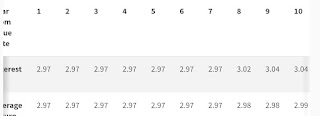

yearly dividend is about 4.84 cents.

Yield is about 5.46%.

NAV 0.90.

Not a call to buy or sell!

Please dyodd.

Corporate Profile

PARAGON REIT, formerly known as SPH REIT, is a Singapore-based real estate investment trust established principally to invest, directly or indirectly, in a portfolio of income-producing real estate which is used primarily for retail purposes in Asia-Pacific, as well as real estate-related assets.

PARAGON REIT was listed on the Singapore Exchange Securities Trading Limited (“SGX-ST”) on 24 July 2013 and is sponsored by Cuscaden Peak Investments Private Limited ("CPIPL" or the "Sponsor"), a wholly owned subsidiary of Cuscaden Peak Pte. Ltd., a consortium made up of three shareholders - Hotel Properties Limited; Mapletree Investments Pte.Ltd., and CLA Real Estate Holdings Pte.Ltd.

As at 31 August 2021, PARAGON REIT’s portfolio comprises five quality and well-located commercial properties in Singapore and Australia. The three properties in Singapore total up to 962,955 sq ft Net Lettable Area (“NLA”) with an aggregate value of S$3.3 billion, whereas the two properties in Australia have an aggregate Gross Lettable Area (“GLA”) of 1,721,801 sq ft, and an aggregate value of A$840.5 million.

Singapore

- Paragon, a premier upscale retail mall and medical suite/office property, is located in the heart of Orchard Road, Singapore’s most famous shopping and tourist precinct. Paragon consists of a 6-storey retail podium and one basement level with 494,442 sq ft of retail NLA (“Paragon Retail”), with a 14-storey tower and another 3-storey tower sitting on top of the retail podium with a total of 223,098 sq ft of medical suites/offices NLA (“Paragon Medical”). It is a 99-year leasehold interest that commenced on 24 July 2013.

- The Clementi Mall, a mid-market suburban mall located in the centre of Clementi town, an established residential estate in the west of Singapore. The retail mall, which also houses a public library, is part of an integrated mixed-use development that includes Housing Development Board (“HDB”) residential blocks and a bus interchange. The property is also directly connected to the Clementi mass rapid transit (“MRT”) station. The Clementi Mall consists of a 5-storey retail podium and one basement level with approximately 195,782 sq ft of retail NLA. It is a 99-year leasehold interest that commenced on 31 August 2010.

- The Rail Mall, a retail strip with a 360-metre prominent road frontage to Upper Bukit Timah Road, an affluent residential neighbourhood and an F&B-dining destination. It is easily accessible via a network of public bus and MRT services through the Downtown Line (“DTL”). Accessibility is further enhanced by its proximity to the island’s major expressways including Bukit Timah Expressway (“BKE”) and Pan Island Expressway (“PIE”). One of the key access points to the Rail Corridor, a popular nature trail, is adjacent to The Rail Mall. The Rail Mall comprises 43 single-storey shop units with a total NLA of 49,882 sq ft. It is a 99-year leasehold interest that commenced on 18 March 1947.

Australia

- Westfield Marion, the largest and only super regional shopping centre in South Australia. It is strategically located in Adelaide, approximately 10 km south-west from Adelaide’s Central Business District (“CBD”). It is in a highly accessible location bound by three major thoroughfares and arterial roads in Diagonal Road, Sturt Road, and Morphett Road, extending its access to shoppers beyond its usual catchment. Westfield Marion is also located next to the Oaklands Train Station, connecting it with Adelaide’s CBD and the southern coastline via multiple train lines. The freehold property sits on a land parcel of approximately 2.5 million sq ft, with approximately 1,495,132 sq ft of Gross Lettable Area (“GLA”). PARAGON REIT has a 50.0% stake in ownership.

- Figtree Grove, an established sub-regional shopping centre located in New South Wales. It is approximately 3 km south-west of Wollongong and approximately 85 km south-west of Sydney CBD. The property is situated at the north-eastern corner of the Princes Highway and The Avenue – major thoroughfares which carry traffic between Wollongong CBD and the wider Wollongong area. The property sits on a freehold land area of approximately 547,883 sq ft and has a total GLA of approximately 236,614 sq ft with 940 carpark lots. PARAGON REIT has an 85.0% stake in ownership.