All information is just for sharing on https://spore-share.com or https://spore-share.blogspot.com (Trade/Invest base on your own decision). Thank You! For trading, be firmed in executing your stop loss strategy. Also don’t be too eager to take profit to early. Let your profit run. For Investing it is good to read up and educate yourself to know the basic financial analysis. Learn how to identify good company to invest . Pick those company/counter that you are familiar with their business.

Ezotop

Thursday, February 22, 2024

Venture Corporation - 4th quarter results is out! Gross Revenue is up 4.3 percent to 736.6m, Net profit is up 5.3 percent to 66.7m. FY total Revenue is down 21.7 percent to 3025m and Net profit is down 26.9 percent to 270m. Free cash flow is positive +100 percent to 439m. Net cash position of 1056m, zero debt. Proposed Final dividend of 50 cents same as last year.

Wednesday, February 21, 2024

UOB Bank - FY results is out! FY Net profit is up 26 percent to 6.1b.4th quarter net profit climbed to S$1.40 billion ($1.04 billion) from S$1.15 billion a year earlier.Proposed a Final dividend of 85 cents as expected but no special dividend or Bonus issue like Dbs bank. Lets see how market react!

UOB Bank - FY results is out! FY Net profit is up 26 percent to 6.1b.4th quarter net profit climbed to S$1.40 billion ($1.04 billion) from S$1.15 billion a year earlier.Proposed a Final dividend of 85 cents as expected but no special dividend or Bonus issue like Dbs bank. Lets see how market react!

XD of 85 cents on 25th April.

At 29.24, yield is about 5.8%.

UOB reported

a 22% rise in net profit in the fourth quarter from a year earlier on the back of higher net fee and non-interest income.

UOB, which is Southeast Asia's third-largest bank by assets, said October-December net profit climbed to S$1.40 billion ($1.04 billion) from S$1.15 billion a year earlier.

The bank recommended the payment of a final dividend of 85 Singapore cents per share, bringing the total dividend for 2023 to S$1.70 per share.

Wilmar Intl - FY 2023 results is out! 2nd Half net profit is down 27.1 percent to 989.3m versus 1264.3m last year! FY net profit is down 35.3 percent to 1566m versus 2419m. Final dividend of 11 cents declared same as last year, i think the results is not bad!

Wilmar Intl - FY 2023 results is out! 2nd Half net profit is down 27.1 percent to 989.3m versus 1264.3m last year! FY net profit is down 35.3 percent to 1566m versus 2419m.

Final dividend of 11 cents declared same as last year, i think the results is not bad!

XD 29th April.

Pls dyodd.

TA wise, bearish mode!

High probability she may go down test 3.26 than 3.23 with extension to 3.0p.

Pls dyodd.

Results is due on 21st February.

Chart wise, bearish mode!

She may likely go down to test 2.98/3.00.

Breaking down of 3.00 plus high volume she may go further down to revisit 2.80 Than 2.43.

Pls dyodd.

Wilmar Intl - She has broken down 3.38 level seem rather Negative and may likely go down to test 3.00! Do take note!

Pls dyodd.

This piece of news reported on the media not sure will it affects the share price! Please dyodd.

Quote : A Chinese subsidiary of Asian food giant Wilmar International F34 0.29% has denied allegations by a city prosecution agency that one of its units was partially accountable for a trade fraud that led to a 5.2 billion yuan (US$725 million) loss for a state-owned company.

https://www.theedgesingapore.com/news/company-news/wilmar-unit-denies-involvement-alleged-china-palm-oil-fraud

Wilmar Intl - She is drifting lower, looks rather interesting! Likely to go down to test 3.39 again! Do take note!

Yearly dividend of 17 cents, yield is 4.94% at 3.44 of which i think is quite a gd yield level!

Breaking down of 3.38 we may see sliding down toward 3.00.

Pls dyodd.

Wah, crucial moment!

I think is good to monitor and wait for market confirmation!

Yearly dividend is 17 cents. Yield is 4.73%. NAV 4.22.

Pls dyodd.

TA wise, bearish mode!

If 3.60 cannot hold the high chance she will go down to test 3.53/3.50. Breaking down of 3.50 plus high volume we may likely see her going down to test 3.28 than 3.00 and 2.94.

Pls dyodd.

Wilmar Intl - Results is out Net profit is down 52.7% to 550m, Total Revenue is down 10% to 32538m.

Declared same interim dividend of 6 cents.

Lower contribution from Food and Feed and I industrial products despite higher sales volume.

Free cash flow of 1.89b.

I think the results is not bad!

Let's see how she fares next week!

Please dyodd.

Wilmar International Limited, founded in 1991 and headquartered in Singapore, is today Asia’s leading agribusiness group. Wilmar is ranked amongst the largest listed companies by market capitalisation on the Singapore Exchange.

At the core of Wilmar’s strategy is an integrated agribusiness model that encompasses the entire value chain of the agricultural commodity business, from cultivation and milling of palm oil and sugarcane, to processing, branding and distribution of a wide range of edible food products in consumer, medium and bulk packaging, animal feeds and industrial agri-products such as oleochemicals and biodiesel. It has over 500 manufacturing plants and an extensive distribution network covering China, India, Indonesia and some 50 other countries and regions. Through scale, integration and the logistical advantages of its business model, Wilmar is able to extract margins at every step of the value chain, thereby reaping operational synergies and cost efficiencies.

Supported by a multinational workforce of about 100,000 people, Wilmar embraces sustainability in its global operations, supply chain and communities.

An Expanding Global Footprint:

From its humble beginnings, Wilmar has today become a global leader in processing and merchandising of edible oils, oilseed crushing, sugar merchandising, milling and refining, production of oleochemicals, specialty fats, palm biodiesel, flour milling, rice milling and consumer pack oils:

- Largest edible oils refiner, specialty fats

and oleochemicals manufacturer as well as leading oilseed crusher, producer of consumer pack oils, flour and rice and one of the largest flour and rice millers in China - One of the largest oil palm plantation owners and the largest palm oil refiner and palm kernel and copra crusher, specialty fats, oleochemicals

and biodiesel manufacturer in Indonesia and Malaysia - Largest producer of branded consumer pack oils in Indonesia

- Largest branded consumer pack oils, specialty fats

and oleochemicals producer and edible oils refiner as well as leading oilseed crusher, sugar miller, refiner and ethanol producer in India - One of the largest investors in oil palm plantations, one of the largest edible oils refiners and producers of consumer pack oils, soaps and detergents as well as third largest sugar producer in Africa

- Largest raw sugar producer and refiner, a leading merchandiser of consumer brands in sugar and sweetener market and largest manufacturer of bread, spreads and sauces in Australia

- Leading refiner of tropical oils in Europe.

Tuesday, February 20, 2024

CapitaLand Investment(9CI.SI) - She has a nice rebound from 2.80 and rises higher to touch 2.95, looks like Bull is in control! Pls take note!

CapitaLand Investment(9CI.SI) - She has a nice rebound from 2.80 and rises higher to touch 2.95, looks like Bull is in control! Pls take note!

Short term wise, I think likely to rise up to retest 2.95 ! A nice breakout smoothly may likely see her rising up towards 3.00 than 3.03.

Pls dyodd.

CapitaLand Investment (9CI.SI) - I think boatvis back! At 2.82 , yield is quite decent at 4.26 percent! Trading at all time low, she is looking rather interesting! Pls dyodd.

Nibbled a bit at 2.82.

Looks like a great pivot point as she has managed to bounce-off from 2.76 this morning!

Pls dyodd.

Wow! Today looks like something is brewing! She is up 12 cents to 3.02.

CapitaLand Invest - The company purchased another 5m share today at 2.90 to 2.92, so solid! They have so much cash on hands to buy back the share! It might be the price is undervalued!

The company just bought back 2.536m share today at 3.00. A few days ago, they also bought back 1m share at 3.00.

This seem like a great support level! Do take note!

Pls dyodd.

https://links.sgx.com/1.0.0/corporate-announcements/SSE7DFS5975TMN0W/a73204226e8e8298ce7a67f8e8d8dbe9e67abbe482df1c9dd26393d3d0dd70e0

She is slowly climbing back above 3.00, looks rather interesting!

Results will be out on 28th February 2024. Estimating Final dividend of 12 cents , nice.

Pls dyodd.

At 2.97 yield is about 4.04%( Final dividend of 12 cents) Or 5.05 is Final dividend is 15 cents.

NAV 2.84.

I think good opportunity is back!

Nibbled a bit at 2.95. Collect dividend while waiting for price to recover.

Pls dyodd.

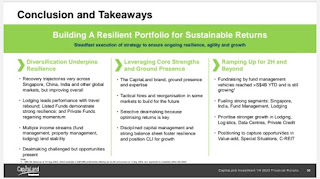

CapitaLand Investment - Results is out, not bad! Total Revenue is down 1% to 1345m, Operating PATMI is dien 1% to 344m, recurring FM fee grow by 10% to 183m, awesome!

I think Results is not bad and Operating profit is quite stable!

I think yearly dividend of 12 cents is sustainable and may be see further increase if FM fee grow faster than expected!

I have nibbled

"CapitaLand Investment remains steadfast in being a trusted partner as we strengthen our position as a leading global real estate investment manager which delivers high quality returns."

CLI’s investment management leadership in Asia began about two decades ago, when we listed Singapore’s first real estate investment trust (REIT), CapitaLand Mall Trust. Today, our six listed funds across Singapore and Malaysia hold a Funds under Management (FUM) of approximately S$60 billion.

And that’s only part of the real estate portfolio that we’ve built — over S$29 billion FUM are also managed through a comprehensive and expanding private funds platform comprising more than 30 private vehicles.

Including assets held directly by CLI as well as assets managed through our global lodging platform, CLI oversees S$133 billion in Real Estate Assets Under Management (RE AUM).

In addition to Singapore, CLI’s core markets include China and India. But our boots on the ground extend far beyond that, to markets across Asia Pacific, Europe, and the USA. Our real estate and management expertise has helped us amass a diversified portfolio of recognisable brands, operating platforms, and asset classes which include retail, office, lodging, business parks, industrial, logistics and data centres.

CapitaLand Investment's (CLI) listed funds business comprises five REITs and business trusts listed on the Singapore Exchange and one on Bursa Malaysia, with a total market capitalisation of S$32.2 billion1. Our listed funds portfolio is focused on driving sustainable distributions and increasing value for our unitholders.

Over time, we have built a strong track record as a Sponsor, making sure our listed funds are always efficiently structured and well-positioned for continued growth.

CapitaLand Investment managed the listed reit companies like Ascendas REIT, CapLand China Trust, CapLand Ibdia Trust, CapitaLand Integrated Commercial Trust and Ascott trust.

CapitaLand Investment (CLI) owns and manages over 1,000 quality properties across the globe, providing a wide range of integrated real estate solutions for work, live and play. The current assets pipeline on CLI's balance sheet provides a diversified stable of high-quality assets with visible monetisation potential.

With a full stack of investment and operating capabilities, we present a unique value proposition for our partners, investors, tenants and customers.

Monday, February 19, 2024

Venture Corporation - She is reporting her FY Financial results on 22nd February, Final dividend of 50 cents is coming. I think interesting moments ! Chart wise, she needs to reclaim 14.13 smoothly in order to rise up further towards 14.35 than 15.35. Pls dyodd.

Venture Corporation - She is reporting her FY Financial results on 22nd February, Final dividend of 50 cents is coming. I think interesting moments !

Chart wise, she needs to reclaim 14.13 smoothly in order to rise up further towards 14.35 than 15.35. Pls dyodd.

Venture - She has retreated below 14 again after clearing it a few days ago, really need a decisively breakout above 14 and stay above in order to continue this uptrend mode!

She is due to report her Full Year results on 22nd February, all eyes are waiting whether will they be any increase in Final dividend.

Pls dyodd.

Venture - Today she has a Nice breakout and cleared the 200 Days Moving Average, Fantastic! Pathing the way for further upwards movement towards 15.00 and above! Do take note!

Finally, she has conquered 14.00 resistance level turned suppor! Likely to rise up to test 15.00 than 15.30 level.

She is due to report her results on 22nd February!

Pls dyodd.

Venture - Chart wise bullish mode! She is looking great to rise up to reclaim 13.98/14. Do take note!

A nice breakout of 14.00 plus good volume would likely see her rising up towards 14.23 than 15.00.

Pls dyodd.

Lai ah, she is rising up nicely to test 14.00 Than 14.23. I think Bull is in control ! Beyond that, we may see her revisiting 15.00 !

Pls dyodd.

Update: VENTURE - Nice Breakout at 13.51 this morning, I think she is soaring higher towards 14.23. Next, she may rise up to test 15.30. Please take note!

Pls dyodd.

Chart wise, bullish mode!

She has managed to stay above the 100 days MA and closed well at 13.30 looks like Bull is in control!

Short term wise, She is likely to rise up to test 13.54 than 14.51 and 15.06.

At 13.30, yield is 5.63% for this blue chips counter which is a

Pls dyodd.

Yesterday, closed well at 13.02 plus high volume Up 49 cents looks rather bullish!

I think likely to clear 13.15 and rises higher to 14 than 14.30 with extension to 16.38.

Pls dyodd.

Quote:

VENTURE Corporation said on Thursday (Nov 30) that its board of directors has established a share buyback plan to purchase up to 10 million ordinary shares of the company.

This plan was authorised by the board on Nov 29, following the approval of Venture’s shareholders of the share purchase mandate at the annual general meeting on Apr 27, the company said in a bourse filing.

Under the mandate, the company can buy up to about 14.5 million shares, which translates to 5 per cent of the total number of issued shares of the company as at the date of the mandate.

Solid! This company cash rich therefore is able to buy back share! Awesome!

Likely to see price rising up to test 13.30 soon!

I am Targeting it can reach 15 to 16 dollars.

Pls dyodd.

21st November 2023:

TA wise, she is gaining strength and likely rise up to reclaim 13.30.

A nice crossing over of 13.30 smoothly we may likely see her moving ip towards 14.25.

Pls dyodd.

Chart wise, bullish mode!

I think she may rise up to test 13.30.

A nice breakout smoothly plus high volume we may see her rising up to test 15.10 than 16.00 and 16.40.

Yearly Dividend is 0.75.

Yield is 5.88% at 12.88.

Pls dyodd.

TA wise, bullish mode!

This morning she has manged to cross over the resistance level at 12.50 plus good volume this is rather positive!

Short term wise, I think likely to rise up to test 13.00 than 13.30 with extension to 14.00 than 14.36.

Not a call to buy or sell!

Pls dyodd.

The recent 3rd quarter results is within expectations.

9 months Net Profit is down 25.2% to 203.3m.

Net cash on hands increase to 956.5m.

I think cash per share is more than 3.00.

SATS - She is gaining strength likely to rise up to reclaim 2.99 again, looks rather bullish!

SATS - She is gaining strength likely to rise up to reclaim 2.99 again, looks rather bullish! A nice breakout of 3.00 smoothly may likely s...

-

NikkoAM-STC Asia ETF Reit - This counter covers most of the famous reit counter like CLAR, CICT, MLT, MIT, MPACT, FCT, FLCT, LINK,SUNTEC ...

-

Chart wise, bearish mode! I think high probability she may go down to test 2.50 than 2.45. At 2.55 yield is about 6.1%. NAV 2.325. Gearing 3...

-

Last Friday, it has broken down the support at 1.80 and closed lower at 1.72 looks like BEAR is in control! At this rate of falling, it m...