After the results announcement, yesterday, it has a nice running up!

I have taken this opportunity to lock in kopi money at 29.62. They are overheads resistance at about 30.10 level so, I would say is good to monitor and don't let your profit slip away!

She is going XD on 4th Aug.

A good sets of financial numbers!

Core Net profit of 3.1b ,solid! Interim dividend increase from 0.60 to 0.85 cents an increase of 41%, fantastic!

XD 4th August, pay date 18th August.

Final dividend of 0.75 + 0.85 , total dividend of 1.60. Awesome! Yield is about 5.6% the highest among the 3 local Bank.

Chart wise, bullish mode! It has managed to trade above 28.60 which is rather positive and we may see her testing 29.00 than 30.00.

Please dyodd.

I think something is brewing judging from the price movement long greenish candlestick! She is up 93 cents to 28.62, Superb!

I think this bullish momentum may push the price higher towards 29.00 than 30.17.

Please dyodd.

It looks like bargain hunters has come in to support. The price has managed to touch the high 0f 28.13 before settling down at 27.83 looks like Buying interest is back!

If it can overcome the resistance at 28.60 smoothly we may likely see her rising up to cover the Gap at about 29.00.

Results is near the corner and if it a gd sets of financial numbers plus a slight increase in dividend I think price may get lifted!

Please dyodd.

TA wise, she has continued to trend lower today down 16 cents to close at 27.24 , looks like Bear is in control!

I think she may go down to test 27.10 then 27.00.

If 27.00 cannot hold then next, we may see her testing 26.40 then 25.94.

Please dyodd.

Chart wise, bearish mode!

She has continued to trade lower and closed at 27.51, looks rather weak!

Short term wise, I think likely to test the pivot low of 27.32.

Breaking down of 27.32 plus high volume we may see her drifting down to test 27 then 26.50 with extension to 26.00.

First half results will be out on 27th July!

Please dyodd.

She is still stucked in a consolidation mode price patterns looks like mkt is giving us chance to monitor her direction!

Today she is down 14 cents to close at 27.82 , yield is about 4.82% seems quite interesting!

NAV 24.46.

Please dyodd.

Chart wise, bearish mode!

She is stucked in a consolidation mode!

Short term wise, if she is able to reclaim 28.60 and filled up the Gap at 28.88 that would likely reverse this downtrend!

Yearly dividend of 1.35. Yield is about 4.8+%.

Pls dyodd.

UOB is rated as one of the world's top banks, ranked 'Aa1' by Moody's Investors Service and 'AA-' by both S&P Global and Fitch Ratings. With a global network of 500 branches and offices across 19 countries in Asia Pacific, Europe and North America.

In Asia, we operate through our head office in Singapore and banking subsidiaries in China, Indonesia, Malaysia, Thailand and Vietnam, as well as branches and offices throughout the region.

The recent acquisition on 11 May 2023:

UOB’s acquisition of Citigroup’s consumer banking businesses in four key ASEAN markets has significantly boosted its retail banking business, and paved the way for its enlarged base of customers in the region to enjoy even more perks and privileges suited to their unique lifestyles and needs via partnerships with renowned domestic and global brands.

The completion of UOB’s acquisition of Citigroup’s consumer banking businesses in Malaysia, Thailand and Vietnam has already brought its regional retail customer count to over seven million as of 31 March 2023, with the latest completion of the Vietnam acquisition enabling the Bank to serve about 200,000 customers in the country. With the completion of the acquisition in Indonesia by end 2023, these four markets are expected to provide a S$1 billion boost to the Bank’s revenue on a full-year basis. The acquisition has also built stronger resilience in the business model with both geographical and revenue mix diversification. With Citigroup’s portfolio more geared towards cards business and unsecured lending, net credit card fees for the Bank almost doubled year-on-year in the first quarter of 2023, with Citigroup’s portfolio contributing a quarter of this, and total income from the Bank’s unsecured business is expected to almost double by end 2023. Separately, loans and deposits also grew almost 10 per cent and 15 per cent in the first quarter of 2023 compared with a year before.

p style="background-color: white; box-sizing: border-box; color: #333333; font-family: "Open Sans", Arial, Heiti, sans-serif; font-size: 15px; margin: 0px 0px 10px;">

For the first quarter of 2023, ASEAN-4 (i.e. Malaysia, Thailand, Indonesia and Vietnam) accounted for more than 35 per cent of the Bank’s Group Personal Financial Services income. UOB’s network of branches in Malaysia, Thailand and Vietnam has also expanded by 15 as of March 2023.

UOB

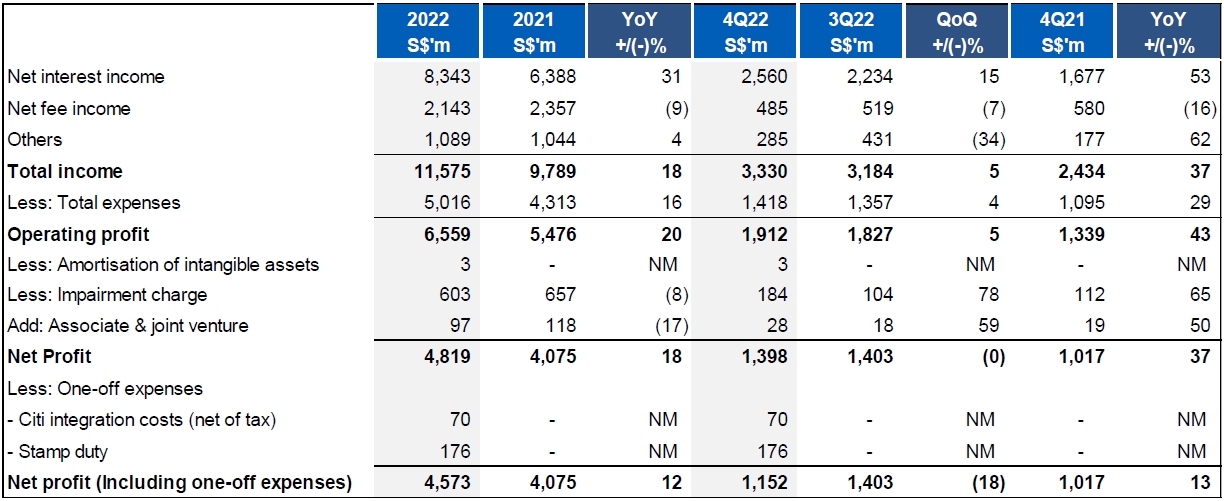

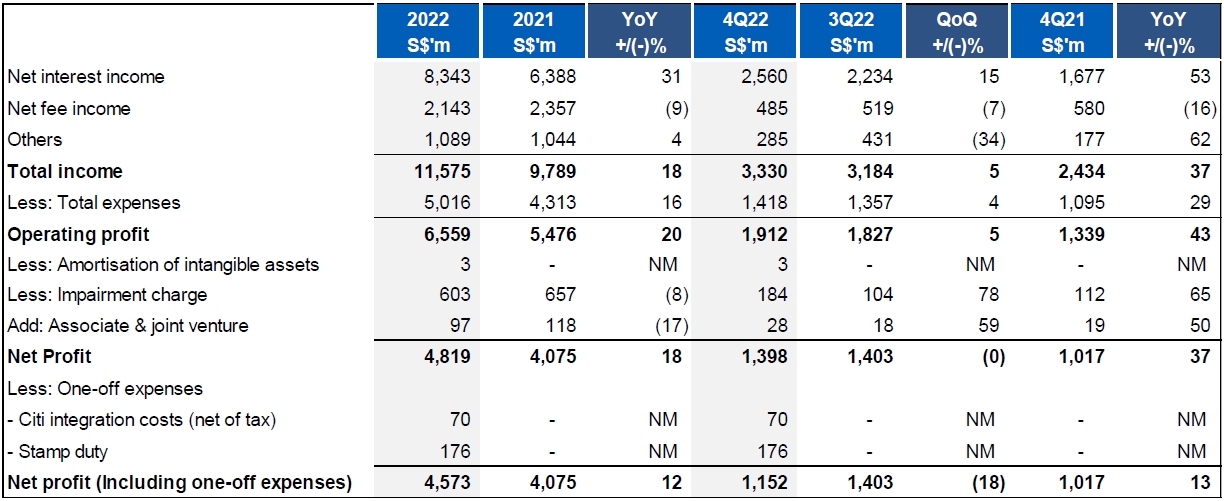

UOB Group reported a record high core net profit of S$4.8 billion, up 18%, for the financial year ended 31 December 2022 (FY22). Including one-off expenses relating to the acquisition of Citigroup’s Malaysia and Thailand consumer businesses, net profit was also a record high at S$4.6 billion.

With strong earnings and capital position, the Board recommends the payment of a final dividend of 75 cents per ordinary share. Together with the interim dividend of 60 cents per ordinary share, the total dividend for FY22 will be S$1.35 per ordinary share, representing a payout ratio of approximately 49%.

The acquisition of Citigroup’s consumer businesses in Malaysia and Thailand was completed in November 2022 and completion for Indonesia and Vietnam is planned for 2023. The strategic acquisition has fortified the Group’s ASEAN strategy and significantly scaled up the retail franchise with increased product offerings and cross-sell opportunities. The Group’s retail customer base has expanded to nearly 7 million in the region while the expected incremental revenue lift from the acquisition is gaining good traction.

In FY22, the Group’s core operating profit rose 20% to S$6.6 billion, mainly driven by robust margin expansion across customer segments and geographies amid rising interest rates. Net interest income jumped 31% to S$8.3 billion on the back of 3% loan growth and a 30 basis point net interest margin improvement. Net fee income remained soft as weak market sentiment weighed on wealth management and loan-related activities. However, a strong double-digit growth in credit card fees partially offset the decline. Asset quality remained benign with non-performing loan (NPL) ratio at 1.6%.

Group Wholesale Banking income rose 23% to S$6.2 billion, with cross-border income up 12%. Transaction banking business expanded, accounting for 35% of the Group’s Wholesale Banking income. Improvement in deposit funding, coupled with rising interest rates fuelled margin growth, which more than compensated for the softer loans growth.

Group Retail income increased 16% to S$4.1 billion. Net interest income was boosted by rising interest rates and the Group’s active balance sheet management to optimise funding cost. Credit card fees surged as consumer spending and regional travel rebounded, boosted by the addition of Citigroup’s consumer businesses in Malaysia and Thailand. Despite market volatility, net new money inflows grew assets under management from affluent customers to S$154 billion. Organically, the Group also added over 800,000 new-to-bank customers, of which more than half were digitally acquired.

The Group continued to make headway on its sustainability strategy in 2022. In November, it announced its net zero commitments by 2050. The Group is working closely with its customers to support them in their transition in an orderly and just manner, focusing on balancing growth with responsibility. The Group’s sustainable financing portfolio reached S$25 billion in FY22, well on track to achieve its target of S$30 billion by 2025. The Group’s total assets under management in environmental, social and governance-focused investments also grew to S$10 billion during the year.

CEO Statement

Mr Wee Ee Cheong, UOB’s Deputy Chairman and Chief Executive Officer, said, “The Group delivered a record net profit for the year, on higher margins driven by our robust core businesses, strong balance sheet and resilient asset quality.

“Importantly, 2022 was a milestone year for UOB with our acquisition of Citigroup’s consumer banking businesses in four markets. Last November, we completed the acquisition in Malaysia and Thailand and we aim to close in Indonesia and Vietnam this year. This transformational deal, sealed in the midst of the pandemic, positions us well in our strategic ambitions in the regional consumer banking space. We are excited to serve our enlarged customer base of 7 million with our expanded network and strengthened capabilities.

“The ASEAN region is vibrant with immense long-term potential. We remain positive on the region despite the global economic gloom in the near term. Looking ahead, we are confident that our strategy of seeking growth while ensuring stability will continue to create value for our customers and other stakeholders.”

Financial Performance

FY22 versus FY21

Core net profit for FY22 grew 18% to a new high of S$4.8 billion from a year ago, boosted by strong net interest income and stable asset quality. Including the one-off expenses, net profit was at S$4.6 billion.

Net interest income increased 31% to S$8.3 billion, led by robust net interest margin expansion of 30 basis points to 1.86% on rising interest rates and loan growth of 3%.

Despite credit card fees registering a double-digit growth from higher customer spending and the consolidation of Citigroup’s credit card business, net fee income declined 9% to S$2.1 billion as muted investor sentiments weighed on wealth and fund management fees.

Customer-related treasury income grew 20%, driven by hedging demands amid market volatility. This was partly offset by impact on hedges and lower valuation on investments. As such, other non-interest income increased 4% to S$1.1 billion.

With income growth outpacing rise in total core operating expenses of 16% to S$5.0 billion, cost-to-income ratio improved by 0.8% points to 43.3%.

Asset quality remained stable. Total allowance declined 8% to S$603 million with the release of pre-emptive general allowance that offset the higher specific allowance. Total credit costs on loans were maintained at 20 basis points.

4Q22 versus 3Q22

Core net profit for the fourth quarter was stable at S$1.4 billion. Including the one-off integration expenses, net profit stood at $1.2 billion.

Net interest income rose 15% to a new record of S$2.6 billion, driven by a 27 basis points uplift in net interest margin to 2.22%. Net fee income was down 7% to S$485 million, due to seasonal slowdown in wealth management and loan-related activities, although credit card fees was at new high from higher customer spends, further boosted by consolidation of Citigroup’s consumer business. Other non-interest income normalised to S$285 million, after an exceptional 3Q22 that benefitted from market volatilities.

Total core operating expenses increased 4% to S$1.4 billion while the cost-to-income ratio was unchanged at 42.6%. Total allowance increased to S$184 million, mainly due to higher specific allowance on a few non-systemic accounts, cushioned by the write-back of general allowance.

4Q22 versus 4Q21

Net interest income increased 53%, led by a 66 basis point expansion in net interest margin and loan growth of 3%. Net fee income was 16% lower as robust credit card fees were more than offset by softer wealth management and loan-related fees. Other non-interest income rose 62% to S$285 million on higher customer-related treasury income.

With strong income growth and disciplined cost management, cost-to-income ratio improved from 45.0% to 42.6%, excluding one-off expenses. Total allowance was S$184 million from higher specific allowance.