At 1.49, yield is about 5.9%. NAV 1.749.

I think during bad time then we can see this kind of depressing price for reit.

I think is good to be cautious!

pls dyodd.

At 1.52, yearly dividend is about 8.86 cents, yield is about 5.82% for this index reit looks rather interesting!

NAV 1.749. Gearing is high at 40.7%. Please take note and do your own due diligence!

Indeed, it has broken down 1.57 and went down to touch 1.50. Looks rather weak!

Yesterday a nice greenish candlestick appeared looks like some buying activities is happening.

Let's monitor and see if it can rise up to reclaim 1.60 !

Please dyodd.

I think she has been driven into an oversold territory looks like a gd pivot point!

NAV is 1.749.

Yearly dpu is about 8.86 cents. Yield is about 5.5%.

In Singapore they own the core assets like VivoCity and Mapletree Business City (MBC). In Hong Kong they own the Famous Festival Walk shopping mall cum commercial office etc.

Chart wise, bearish mode!

It 1.60 cannot hold up well then next support is at 1.57.

Please dyodd.

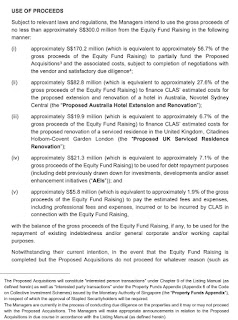

The results is so so!

NPI is up 1% to 179.2m.

Finance costs increase 6.1% to 54m.

Distribution income is down 2.4% to 114.7m.

Dpu of 2.18 cents versus 2.25 cents last quarter.

Occupancy rate is 95.7%.

Gearing 40.7%.

Results is due on 31st July!

Is it a tell tale sign results might not be good!

Pls dyodd.

Chart wise, she is gaining strength and likely rise up to test 1.70-1.72!

A nice breakout at 1.72 plus good volume we may likely see her rising up further towards 1.80 than 1.85.

Please dyodd.

I nibbled a bit at 1.61 as it is hovering at the major support level!

Not a call to buy or sell!

Pls dyodd.

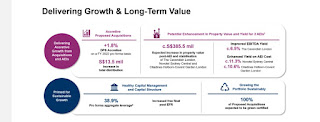

Mapletree Pan Asia Commercial Trust (“MPACT”) is a real estate investment trust (“REIT”) positioned to be the proxy to key gateway markets of Asia. Listed on the Singapore Exchange Securities Limited (“SGX-ST”), it made its public market debut as Mapletree Commercial Trust on 27 April 2011 and was renamed MPACT on 3 August 2022 following the merger with Mapletree North Asia Commercial Trust.

Its principal investment objective is to invest on a long-term basis, directly or indirectly, in a diversified portfolio of income-producing real estate used primarily for office and/or retail purposes, as well as real estate-related assets, in the key gateway markets of Asia (including but not limited to Singapore, China, Hong Kong1, Japan and South Korea).

MPACT’s portfolio comprises 18 commercial properties across five key gateway markets of Asia – five in Singapore, one in Hong Kong, two in China, nine in Japan and one in South Korea. They have a total NLA of 11.0 million square feet and valued at S$17.1 billion.

Within Singapore, they are:

- VivoCity – Singapore’s largest mall located in the HarbourFront Precinct;

- Mapletree Business City (“MBC”) – a large-scale integrated office, business park and retail complex with Grade A building specifications, supported by ancillary retail space, located in the Alexandra Precinct;

- mTower – an established integrated development with a 40-storey office block and a three-storey retail centre, Alexandra Retail Centre (“ARC”), located in the Alexandra Precinct;

- Mapletree Anson – a 19-storey premium office building located in the Central Business District (“CBD”); and

- Bank of America HarbourFront (“BOAHF”) – A premium six-storey office building located in the HarbourFront Precinct.

Outside Singapore, they are:

- Festival Walk, Hong Kong – a landmark territorial retail mall with an office component;

- Gateway Plaza, China – a Grade A office building with a podium area in Lufthansa sub-market within Beijing;

- Sandhill Plaza, China – a Grade A business park development in Zhangjiang Science City, a key business and innovation hub in Pudong, Shanghai;

- Japan Properties – nine freehold properties comprising five office buildings in Tokyo (IXINAL Monzen-nakacho Building, Higashi-nihonbashi 1-chome Building, TS Ikebukuro Building, Omori Prime Building and Hewlett-Packard Japan Headquarters Building); an office building in Yokohama (ABAS Shin-Yokohama Building) and three office buildings in Chiba (SII Makuhari Building, Fujitsu Makuhari Building and mBAY POINT Makuhari); and

- The Pinnacle Gangnam, South Korea – a freehold Grade A office building with retail amenities located in Gangnam Business District, Seoul.