Last Friday closed lower at 12.79 with a Gap Down looks rather negative! Likely to see further selling down pressure!

Short term wise, I think likely to go down to test 12.60 than 12.41 . Next she may go further down to test 12.17 than 12.00.

Please dyodd.

TA wise, bearish mode!

I think likely to go down to test 12.17 than 12.00.

Please dyodd.

Chart wise, bearish mode!

She is going Ex.dividend on 14th August, I think market is giving chance to secure the profit!

She is trading near the peak resistance and it may experience the same selling down price patterns as reflected on the chart!

As interest rate is more or less peak and bank Net Interest Margin likely fall plus bad debts allowance might increase therefore, total Revenue and Net income may be lowered!

US bank already seen Analyst lowering their TP. I think is good ro be cautious!

Not a call to buy or sell!

Please dyodd.

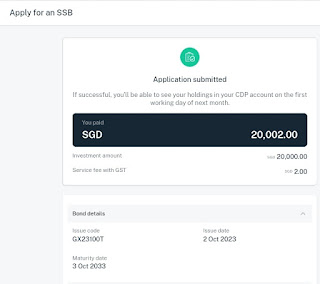

So fast, asking for loan liao!

4.5% seem not bad!

Not a call to buy or sell.

Please dyodd.

Wah, another Gap down upon results released looks like market already priced in the good sets of financial numbers and it doesn't boils well for this kind of price action!

Looks like the uptrend direction is halted and we may see further selling down pressure!

Please dyodd.

All the 3 local banks attained good profit and all boosting their dividend payout. But going forward, profit may be lowered due to interest rate pause or bad debts allowance.

Total Income of 6.8b.

RoE of 14.3%.

EPS 1.60 per share.

Interim dividend increase 43% from 0.28 to 0.40.

XD 14 August, pay date 25 August.

Yield of 6%. Is much higher than index reit.

TA wise, looks like the same price patterns may repeat itself!

After hitting the resistance level it may likely see further weakness.

I think is never wrong to lock in profit!

Don't let the profit slip away!

Please dyodd.

TA wise, bearish mode!

If she can't hold at 12.00 price level,

the next support level Is 11.93 than 11.80.

Please dyodd.

Chart wise, bearish mode!

Likely to see further weakness!

Immediate support is at about 12.20.

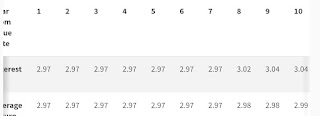

Yearly dividend is about 0.65-0.68.

Yield is about 5.29% or 5.5% at 12.28 seems quite a gd yield!

Pls dyodd.

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912. It is now the second largest financial services group in Southeast Asia by assets and one of the world’s most highly-rated banks, with Aa1 by Moody’s and AA- by both Fitch and S&P. Recognised for its financial strength and stability, OCBC Bank is consistently ranked among the World’s Top 50 Safest Banks by Global Finance and has been named Best Managed Bank in Singapore by The Asian Banker.

OCBC Bank and its subsidiaries offer a broad array of commercial banking, specialist financial and wealth management services, ranging from consumer, corporate, investment, private and transaction banking to treasury, insurance, asset management and stockbroking services.

OCBC Bank’s key markets are Singapore, Malaysia, Indonesia and Greater China. It has more than 420 branches and representative offices in 19 countries and regions. These include over 190 branches and offices in Indonesia under subsidiary Bank OCBC NISP, and over 60 branches and offices in Mainland China, Hong Kong SAR and Macau SAR under OCBC Wing Hang.

OCBC Bank’s private banking services are provided by its wholly-owned subsidiary Bank of Singapore, which operates on a unique open-architecture product platform to source for the best-in-class products to meet its clients’ goals.

OCBC Bank's insurance subsidiary, Great Eastern Holdings, is the oldest and most established life insurance group in Singapore and Malaysia. Its asset management subsidiary, Lion Global Investors, is one of the largest private sector asset management companies in Southeast Asia.

Yearly dividend of about 0.65 to 0.68.

Current Price of 12.23, yield is about 5.31% /5.5%.

P/B is slightly above 1.

The dividend yield is above 5% which is considered good!

Chart wise, it is trading in a consolidation mode!

Waiting for the next catalyst to drive the price higher.

Looking at the chart we can see some buying interest with huge volume transacted on certain day which is rather interesting!

Will it repeat the same price patterns!

We will know the answer in next few trading sessions!

Pls dyodd.